The Starter Investor Reviews Best Value-Packed Online Brokers for 2023

Updated March 25, 2023

Discovering the Best Value-Packed Online Brokers: A Review for Online Stock Traders Seeking Quality and Affordability for 2023

TABLE OF CONTENTS

Best Online Brokers for Online Trading on a Budget

Comparing the Best Online Brokers

BPI Trade

COL Financial

Top 5 Essential Criteria

5-Point System for Evaluating Online Brokers

Categories of Online Brokers Based on Their Score

ONLINE TRADING has become a popular way for Filipinos to invest their money and grow their wealth. However, choosing the right online broker can be a daunting task, especially for those who are on a limited budget. In this article, we will discuss the top 5 essential criteria for online stock traders on a budget and provide a 5-point scoring system for evaluating online brokers based on these criteria. Our evaluation is based on personal experience, and as such, our final assessment may differ from those of individuals with varied experiences.

Best Online Brokers and Trading Platforms for Online Trading on a Tight Budget

Name of Online Broker:

QUICK FACTS:

Minimum Deposit:

Php 0

Notes:

- Your BPI Trade Settlement Account (SETA) requires an Average Daily Balance (ADB) of Php500.00 (visit www.bpi.com.ph for details).

- You must have an existing BPI Bank Deposit account(s).

Fees:

For buying and selling transactions (Peso Denominated):

Fund your account:

There are four ways to fund your account:

- BPI Online: Enroll your BPI Trade SETA in your BPI Online account and transfer funds from your other BPI or BPI Family Bank accounts.

- Branch Deposit. Go to any BPI Branch and make an over-the-counter deposit to your BPI Trade SETA.

- E-Wallet. Send money from your GCash or other E-Wallet account to your BPI Trade SETA. This service may impose fees for sending money to a bank.

- From Other Bank. Send money from your account with another bank to your BPI Trade SETA using InstaPay or PESONet.

Why We Selected It:

- BPI Trade offers a convenient option for those who already have an existing BPI Bank Deposit Account.

- Reactivating a dormant trading account is a simple process, and the BPI Phone Banking facility is also available for account maintenance and other concerns.

- Depositing and withdrawing funds from your BPI Trade account is seamless and convenient. (For more information, please refer to BPI Trade's website or customer support).

Pros & Cons:

Pros:

- No minimum investment is required to open a BPI Trade account.

- Backed by the BPI brand's 161-year leadership and expertise.

- Unmatched end-to-end convenience, with seamless fund transfers between BPI banking and trading accounts.

- Superior technology that offers a reliable and user-friendly online trading platform.

- A highly-regarded research team.

- Dedicated customer service group that ensures all your queries and concerns are addressed promptly.

Cons:

- BPI Trade Settlement Account (SETA) requires an Average Daily Balance (ADB) of Php500.00.

Overview:

BPI TRADE is the internet-based platform for trading stocks offered by BPI Securities. Using this online portal, you can purchase and sell shares of publicly traded firms on the PSE. With BPI Trade, you have the ability to place online orders with the PSE, obtain real-time stock market quotations, and access extensive research and highly effective portfolio management with just a few clicks.

BPI Trade's mission is to become the most reliable and respected local broker in the Philippines. Always prioritize customers' interests and financial objectives by offering a seamless and end-to-end trading experience, unbiased and expert investment advice, and a strong and user-friendly trading platform.

Our verdict:

- Score: 24

- Value-Packed Best Online Broker for Beginners and Best Online Broker for Mobile.

Name of Online Broker:

QUICK FACTS

Minimum Deposit:

Php1,000.00Fees:

- Commission: 0.25% of the Gross Trade Amount

- Value Add Tax (VAT): 12% of Commission

- Philippine Stock Exchange Transaction Fee (PSE Trans Fee): 0.005% of the Gross Trade Amount

- Securities Clearing Corporation of the Philippines Fee (SCCP): 0.01% of Gross Trade Amount

Additional fee for selling:

- Sales Tax: No. of Shares x Price x 0.006

* Note: The Commission fee has a minimum charge of P20.00 per transaction. And if you require a broker-assisted trade, the commission charge is 0.5% of the Gross Trade Amount.

Fund your account:

Online Banking via Bills Payment

Use your online banking facility to fund your COL account. Just enroll COL FINANCIAL under your bills payment then pay that bill.

- Banco de Oro (BDO)

- Bank of the Philippine Islands (BPI)

- Metrobank

- Asia United Bank (AUB)

- Chinabank

- Robinsons Bank

- Unionbank

- PNB

Funding via E-wallet Bills Payment

- GCash

- Maya

Over-the-Counter via Bills Payment

Visit any of their partner bank branches and fill out a payment slip. Forms of payment can be in cash or check. Check should be payable to COL FINANCIAL GROUP, INC.

- Banco de Oro (BDO)

- Bank of the Philippine Islands (BPI)

- Metrobank

- Asia United Bank (AUB)

- Robinsons Bank

- Unionbank

- PNB

How to withdraw funds from your account:

COL clients can now withdraw their funds using an Online Withdrawal Facility. Your funds are transferred to the Enrolled bank Account that you nominated in your application form.

Why We Chose It:

- Affordable and accessible way to invest in the Philippine Stock Market.

- Automated order placement and execution via the internet.

- Access to live quotes and other market statistics.

- Online portfolio tracker.

- Research materials and market commentaries.

- Price charting program and Ticker system display.

Pros & Cons

Pros:

- Account activation within 24 hours of email and mobile number verification.

- Offers options for different account types with varying minimum deposits:

- For Starter accounts, the minimum deposit is Php1,000.

- For Plus accounts, the minimum deposit is Php25,000.

- For Premium accounts, the minimum deposit is Php1,000,000.

- Invitations to regular market briefings and timely strategy forums.

- Superior customer support.

Cons:

- Requires a minimum deposit of Php1,000 for Starter accounts.

Overview:

COL Financial was founded in 1999 to provide an affordable and accessible way for Filipinos to invest in the Philippine Stock Market. Since then, it has expanded its services to empower individual investors with real-time quotes, research reports, and expert-broker support to help them make informed investment decisions. It also offers real-time execution of trades, which is the industry standard for online trading. With its focus on serving experienced investors seeking a more convenient way to trade stocks, COL Financial is well-positioned to drive the growth of the online trading market in tandem with the increasing availability of internet access, broadband services, and tech-savvy investors.

Our verdict:

- Score: 24

- Value-Packed Best Online Broker for Beginners and Best Online Broker for Mobile.

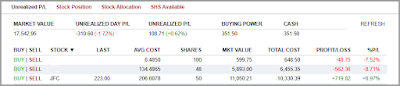

Timeline for our COL Financial Online Trading Activities: Week 01

March 21, 5:00 AM: Email address & mobile number verified.

March 21, 10:00 AM: Application approved.

March 21, 11:00 AM: Funded the account by Online Banking.

March 21, 4:00 PM: Acknowledgment of Deposit.

March 21, 4:00 PM: Trading Account activated.

March 22, 9:30 AM: 1st Buy Order executed.

March 22, 10:00 AM: Funded the account by GCash Bills Payment.

March 23, 12:30 AM: Trading Confirmation for our 1st Buy Order.

March 23, 8:00 AM: Acknowledgment of Deposit via GCash Bills Payment.

March 23, 10:00 AM: 2nd Buy Order executed.

March 23, 5:00 PM: Funded the account by Maya Bills Payment.

March 24, 1:20 AM: Trading Confirmation for our 2nd Buy Order.

March 24, 8:30 AM: Acknowledgment of Deposit via Maya Bills Payment.

March 24, 11:00 AM: 3rd Buy Order executed.

March 25, 1:50 AM: Trading Confirmation for our 3rd Buy Order.

Comparing the Best Online Brokers

Rating Methodology: Top 5 Essential Criteria for Online Stock Traders on a Budget

Types of Accounts, Deposit Requirements, and Trading Fees: What to Consider When Choosing an Online Broker

When it comes to online stock trading, choosing the right brokerage can make all the difference. As an aspiring online trader on a budget, there are several criteria you need to consider before picking a broker. Here are some key factors to look for:

Account Types and Minimum Deposit

Different brokers offer various types of accounts with different features and requirements, and it's essential to choose one that fits your needs and budget. Make sure to consider the minimum deposit required to open an account and the types of accounts available.

Trading Fees and Charges

The trading fees and charges of an online broker can have a significant impact on your profitability. Look for brokers that offer competitive rates without compromising the quality of their services. Consider the commission fees, minimum deposit, withdrawal fees, and other charges of each broker before making a decision.

Trading Platform

The trading platform is the software that online traders use to execute their trades, monitor their portfolio, and access market data and analysis. A good trading platform should be user-friendly, stable, and offer advanced features such as real-time quotes, charting tools, and order management. Look for brokers that offer a web-based or mobile-based platform that can be accessed from anywhere and at any time.

Customer Support

Customer support is an essential aspect of online trading, as traders may encounter technical issues or have questions about their account or trades. Look for brokers that offer responsive and knowledgeable customer support through various channels such as phone, email, live chat, or social media. It's also advisable to check the broker's operating hours and language options to ensure that you can reach them when you need to.

Security and Reliability

The security and reliability of an online broker are critical factors to consider, especially since online trading involves the exchange of sensitive information and the management of financial assets. Look for brokers that are licensed and regulated by the Philippine Securities and Exchange Commission (SEC) or other reputable regulatory bodies. Check for security features such as encryption, two-factor authentication, and fraud detection systems.

Other Criteria

Educational resources and research tools

Successful online traders need to have a solid understanding of the market, industry trends, and trading strategies. Look for brokers that offer educational resources such as webinars, tutorials, and articles, as well as research tools such as stock screeners, news feeds, and market analysis. These resources can help traders make informed decisions and improve their trading skills.

Reputation

Check the broker's reputation by looking for reviews and feedback from other traders in the Philippines. A good broker will have positive reviews from satisfied customers and a track record of delivering excellent service.

Scoring Criteria: Our 5-Point System for Evaluating Online Brokers

To evaluate online brokers based on the top 5 criteria, we used a 5-point scoring system as follows:

- Excellent (5 points): the broker exceeds expectations in all criteria and offers exceptional value and quality.

- Good (4 points): the broker meets the expectations in most criteria and offers good value and quality.

- Average (3 points): the broker meets the expectations in some criteria but may have some drawbacks or limitations.

- Fair (2 points): the broker falls short of expectations in most criteria and may have significant drawbacks or limitations.

- Poor (1 point): the broker fails to meet expectations in all criteria and offers poor value and quality.

Categorizing Online Brokers Based on Their Scores

Based on the scores obtained from the 5-point scoring system, we have categorized online brokers as follows:

- Value-Packed Brokers (scores of 20-25): these brokers offer excellent value for money, providing affordable rates without compromising quality and reliability. With robust customer support, they are ideal for budget-conscious traders who prioritize quality and security.

- Balanced Brokers (scores of 15-19): these brokers strike a balance between affordability and quality. While they may have some limitations or drawbacks, they generally provide a satisfactory overall trading experience for traders who prioritize a balance between cost and value.

- Premium Brokers: (scores of 0-14): these brokers offer high-end services and features, but at a premium cost. They may be suitable for investors with larger budgets or those seeking exclusive investment opportunities but may not be the best fit for budget-conscious traders looking for cost-effective trading options.

Helpful Articles and Websites

You may also find the following websites and articles helpful:

Stock Trading Websites

The Philippine Stock Exchange, Inc.

Stock Trading Articles

The Philippine Stock Exhange, Inc.

BDO:

How to Invest in the Philippine Stock Market

gritPH:

9 Best Online Trading Platforms in the Philippines

smartpinoyinvestor.com:

Moneymax:

How to Invest in Stocks for Beginners (Even with Little Money)

Investment Articles

COL Financial:

Bangko Sentral ng Pilipinas:

Metrobank:

Stock investment 101: Long-term investments through stock market trading

Moneymax:

Reach Your Financial Goals with the Best Investments in the Philippines

Where Can I Invest My 1,000 Pesos? 9 Affordable Investments to Consider

Related Articles

Building Wealth in Later Life: Investment Opportunities for the Fourth Quarter (Ages 55-65)