The Starter Investor Reading Notes on Stock Trading Strategies

Effective from our update on April 5, 2023, we have rebranded from Marginal Investor to The Starter Investor. For additional details, please visit our About Us page.

Updated March 24, 2023

Top 5 Strategies to Consider When Trading Stocks Online

ONLINE STOCK TRADING can be a lucrative way to invest your money, but it requires careful planning and execution. The main consideration for our online trading activities is to apply some of the principles as we understood them, from the book "The Intelligent Investor" by Benjamin Graham. It is in our curiosity to know if online trading today can be guided by a rather dated knowledge of investing. In addition, we are open to other expert knowledge from the investors that we may meet, more likely adding the investment learnings to our own, as we develop and pursue our online trading strategies.

Here are some strategies to consider when trading stocks online:

#1 Set Your Objectives

The first step in developing an online stock trading strategy is to set your objectives. What do you want to achieve? Are you looking to make a quick profit or build a long-term portfolio?

What we think:

In the case of our Online Stock Trading activities, we have set our short-term, medium-term and long-term financial objectives for growing our investment portfolio as follows:

- Short-Term Objective ending on March 31, 2026, is Php 100,000.00

- Medium-Term Objective ending on March 31, 2028, is Php 1,000,000.00

- Long-Term Objective ending on March 31, 2033, is Php 15,000,000.00

#2 Conduct Market Research

Before buying or selling any stock, it's important to conduct market research. This can include analyzing market trends, evaluating the performance of specific companies, and monitoring news and industry updates.

To guide our approach to market research, we will be applying some principles that are outlined in "The Intelligent Investor" book.

In the section dealing with Common-Stock Analysis, it says that the ideal form of common-stock analysis leads to a valuation of the issue which can be compared with the current price to determine whether or not the security is an attractive purchase. This valuation, in turn, would ordinarily be found by estimating the average earnings over a period of years in the future and then multiplying that estimate by an appropriate “capitalization factor.”

Meanwhile, some of the factors affecting the capitalization rate include:

- General Long-Term Prospects

- Management

- Financial Strength and Capital Structure

- Dividend Record

- Current Dividend Rate

But for our purposes, we are going to use this advice from Graham: It is undoubtedly better to concentrate on one stock that you know is going to prove highly profitable, rather than dilute your results to a mediocre figure, merely for diversification’s sake.

#3 Develop a Trading Plan

A trading plan is a set of rules and guidelines that you follow when buying and selling stocks. This can include setting entry and exit points, establishing stop-loss orders to minimize losses, and determining your risk tolerance. A trading plan can help you stay disciplined and avoid making impulsive decisions.

What we think:

We belong to that group of investors who have an aggressive risk appetite. We are willing to take on higher risks in order to potentially earn higher returns on our investments. We are comfortable with investing in high-risk investments such as stocks. We are willing to accept the possibility of significant losses in order to potentially earn higher profits, and we also have a long-term investment horizon.

Our trading plan follows our own Online Trading Cycle Strategy:

- We start with accumulating savings to have liquidity.

- When we have enough liquidity, it is time to purchase and build our common stock portfolio. Our limited portfolio will have a maximum of 7-9 common stocks on the list.

- For now, we are going to follow the lead of the fund manager of ATRAM Philippine Equity Smart Index Fund, which is also part of our investment portfolio using the GCash app platform via its suite of financial services that include GFunds. As of November 29, 2022, their fund picks are:

- SM Investments (SM), and

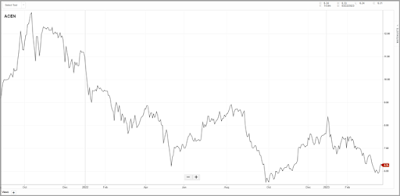

- To complete our stock portfolio based on our target entry and exit points, we would also contemplate adding 3-5 more stocks. Our analysis led us to identify AC Energy Philippines, Inc. (ACEN) as an appealing investment option, with a Year-To-Date %Change of -21.65% as of 23-Mar-2023. Therefore, we have chosen ACEN as the top choice for our enterprising stock portfolio:

ACEN - AC Energy Philippines, Inc. as of March 23, 2023, screen capture of chart generated by COL Financial

#4 Monitor Your Portfolio

Once you start trading stocks online, it's important to monitor your portfolio regularly. This includes tracking the performance of individual stocks, evaluating your overall portfolio balance, and making adjustments as needed. You should also stay informed about market conditions and any relevant news or events that could impact your investments.

What we think:

We monitor our stock portfolio regularly to seek if our exit point had been reached; or if it is time to enter the market and buy more stocks based on the decision criteria set in our trading plan.

#5 Know When to Buy and Sell

The decision to buy or sell a stock can be influenced by a variety of factors, including market trends, company performance, and economic indicators. Some common decision points include buying when a stock is undervalued or selling when it reaches a target price or shows signs of weakness.

What we think:

- We enter the market or buy the stock when others are fearful and selling it. For purposes of our stock trading plan, a year-to-date (YTD) change of around -9% to -10% or a 52-week change of -20% to -40% would be attractive to us. Otherwise, we hold on to cash.

AEV - Aboitiz Equity Ventures, Inc. as of March 23, 2023, screen capture of chart generated by BPI Trade

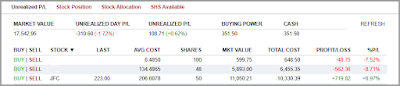

- We exit the market or sell the stock when the market price of our position has reached the range of 6% to 12% gain or better, with respect to our average purchase price.

JFC - Jollibee Food Corporation online stock trading portfolio market valuation as of March 23, 2023

Ultimately, successful online stock trading requires a combination of research, analysis, and discipline. By setting clear objectives, developing a trading plan, and staying informed about market conditions, you can make informed decisions about when to buy and sell stocks.

If you're looking to stay up-to-date on the latest online stock trading activities, then we invite you to continue following our blog. In the coming weeks and months, I'll be sharing even more tips and strategies for successful investing in today's ever-changing market. So, if you want to stay informed and stay ahead of the game, be sure to keep checking back for my latest articles.

Related post:

You may also find the following websites and articles helpful:

Building Wealth in Later Life: Investment Opportunities for the Fourth Quarter (Ages 55-65)

Best investing lessons for beginners in the Philippines

Top 11 Picks: Online Brokers in the Philippines for Novice Traders with Limited Funds